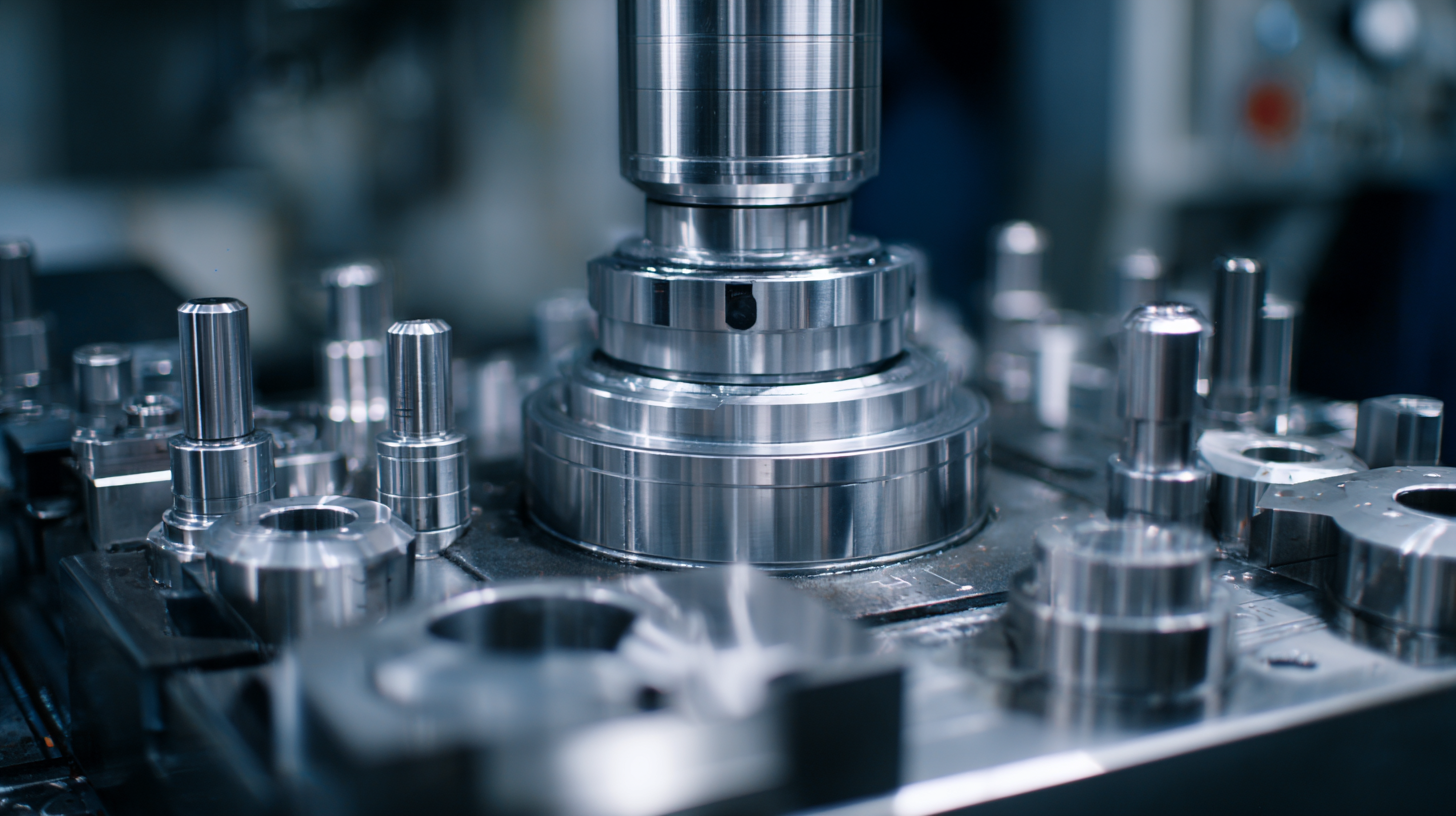

In today's competitive global marketplace, precision machining stands out as a critical component for manufacturers seeking high-quality components and parts. According to a recent report by the U.S. Bureau of Labor Statistics, the precision machining industry is projected to grow by 5% over the next decade, reflecting a rising demand for custom-engineered solutions across sectors such as aerospace, automotive, and medical devices. The ability to meet stringent specifications with accuracy and efficiency is paramount, making it crucial for global buyers to identify the best precision machining solutions. This ultimate guide offers an in-depth look into the technical parameters and methodologies that define superior precision machining, empowering manufacturers to make informed decisions that align with their quality and production standards.

The precision machining market is witnessing significant evolution, driven by technological advancements and increasing demands across various industries. As we look towards 2025, the global CNC machine market is projected to expand from $101.22 billion to $195.59 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 9.9%. This growth is indicative of the rising adoption of automation and precision engineering solutions, essential for enhancing productivity and accuracy in manufacturing processes.

Key trends shaping this landscape include the integration of Industry 4.0 technologies, such as IoT and artificial intelligence, which are revolutionizing production capabilities. Moreover, there is a notable shift towards sustainability, with buyers increasingly prioritizing eco-friendly machining solutions. As manufacturers respond to these market dynamics, global buyers are presented with a wealth of opportunities to harness precision machining technologies that not only meet their operational needs but also align with future growth trajectories. By 2030, sectors like North America’s contract manufacturing services are also expected to witness similar growth patterns, highlighting the interconnected nature of the machining market with broader economic trends.

The precision machining industry is experiencing significant growth driven by geographic demand in various regions around the globe. Key markets such as North America and Asia-Pacific are leading the charge, fueled by advancements in automation and an increasing reliance on high-precision components across diverse sectors, including automotive, aerospace, and medical devices. As companies look to enhance their operational efficiency, the demand for advanced precision machining solutions is set to rise sharply, with projections indicating robust growth rates across multiple sectors.

Notably, the CNC machine market, which is a critical component of precision machining, is expected to witness remarkable expansion. With a forecasted growth from $101.22 billion in 2025 to $195.59 billion by 2032, this sector exemplifies the shifting dynamics in machining solutions. Moreover, the rise of electrical discharge machining (EDM) and custom tooling solutions are also indicative of the ongoing transformation in manufacturing processes across key regions. As global buyers prioritize precision and quality in manufacturing, understanding regional demands will be crucial for businesses seeking to thrive in this competitive landscape.

| Region | Market Demand (USD Billion) | Growth Rate (%) | Key Industries |

|---|---|---|---|

| North America | 15.3 | 4.5 | Aerospace, Automotive, Medical |

| Europe | 14.1 | 3.8 | Manufacturing, Defense, Energy |

| Asia-Pacific | 20.0 | 6.7 | Electronics, Automotive, Robotics |

| Latin America | 5.2 | 3.2 | Consumer Goods, Construction |

| Middle East & Africa | 3.8 | 4.0 | Oil & Gas, Mining, Construction |

Technological advancements have significantly transformed the landscape of precision machining, offering global buyers an unprecedented opportunity to enhance efficiency and precision in their manufacturing processes. Automation and the integration of advanced software solutions have streamlined operations, allowing companies to optimize their workflows and reduce production time. For instance, Computer Numerical Control (CNC) machines equipped with state-of-the-art software can execute complex designs with remarkable accuracy, minimizing human error and maximizing throughput.

In addition, the rise of Industry 4.0 has introduced smart manufacturing technologies that enable real-time monitoring and data analytics in precision machining. These innovations allow manufacturers to track the performance of their machines, predict maintenance needs, and adjust parameters dynamically to maintain optimal quality standards. As global buyers seek to source the best precision machining solutions, understanding the implications of these technological advancements becomes crucial, not only for improving efficiency but also for fostering innovation and competitiveness in an increasingly globalized market.

In the competitive landscape of precision machining, optimizing your investment becomes crucial, especially as we approach 2025. Cost-effectiveness is not merely about choosing the cheapest option; it involves a strategic approach to sourcing and managing machining solutions. Global buyers must consider factors such as material costs, manufacturing techniques, and supplier capabilities. Collaborating with vendors who employ advanced technologies can significantly lower production costs while improving quality and turnaround time.

Investing in automation and modern CNC machinery can also enhance efficiency and precision, reducing waste and rework. Implementing lean manufacturing principles helps streamline processes and identify areas for cost reduction. Moreover, maintaining a strong relationship with suppliers can lead to better pricing and priority service, ensuring that your production runs smoothly.

Ultimately, effective cost management in precision machining hinges on making informed decisions that balance quality and expenditure. By focusing on long-term relationships and innovative solutions, buyers can maximize their return on investment while ensuring reliable and high-caliber results. Navigating this landscape thoughtfully will enable global buyers to thrive in the evolving manufacturing environment of 2025 and beyond.

In the global machining industry, navigating regulatory compliance and quality standards is paramount for buyers seeking precision machining solutions. According to a report by Markets and Markets, the global precision machining market is projected to reach USD 99.58 billion by 2025, driven by the rising demand for high-quality components in industries such as aerospace, automotive, and medical devices. With such significant growth, understanding and adhering to international compliance frameworks becomes crucial for maintaining competitive advantage.

Regulatory bodies, including ISO (International Organization for Standardization) and AS9100 (a quality management system for aerospace), set stringent standards to ensure product quality and safety. Getting certified not only helps in streamlining processes but also enhances buyer confidence. A study by the International Association for Six Sigma Certification indicates that companies adhering to compliance standards can reduce waste by approximately 30% and improve efficiency by 20%. Thus, global buyers must prioritize partnerships with machining solutions providers that emphasize regulatory adherence and showcase certifications, ensuring that they receive top-quality machining services that meet necessary global standards.

Contact

KYOCERA SGS Precision Tools, Inc.

(330) 686-5700

150 Marc Drive

Cuyahoga Falls, OH 44223

Products

Resources